Blog

QRIS Surges: National Digital Payment Revolution Displaces Visa and MasterCard

Tel-Access

24 April 2025

QRIS Surges: National Digital Payment Revolution Displaces Visa and MasterCard

Quick Response Code Indonesian Standard (QRIS)-based digital payment system continues to experience astonishing growth. Amidst the transformation of people’s lifestyles towards digitalisation, QRIS has not only become the primary choice in the domestic market, but has also shifted the long-standing dominance of foreign payment systems such as Visa and MasterCard.

Digital Transformation Through QRIS

QRIS, launched by Bank Indonesia (BI) together with the Indonesian Payment System Association (ASPI) in 2019, was designed as a single solution to unite various payment platforms. With one QR code, all digital wallets and mobile banking services can be used, making QRIS the new national standard.

‘QRIS is the main foundation in creating an efficient, affordable, and inclusive digital payment ecosystem,’ said the Deputy Governor of BI in a statement. In 5 years, QRIS has been used by more than 55 million users and accepted by more than 35 million merchants, most of which are MSMEs.

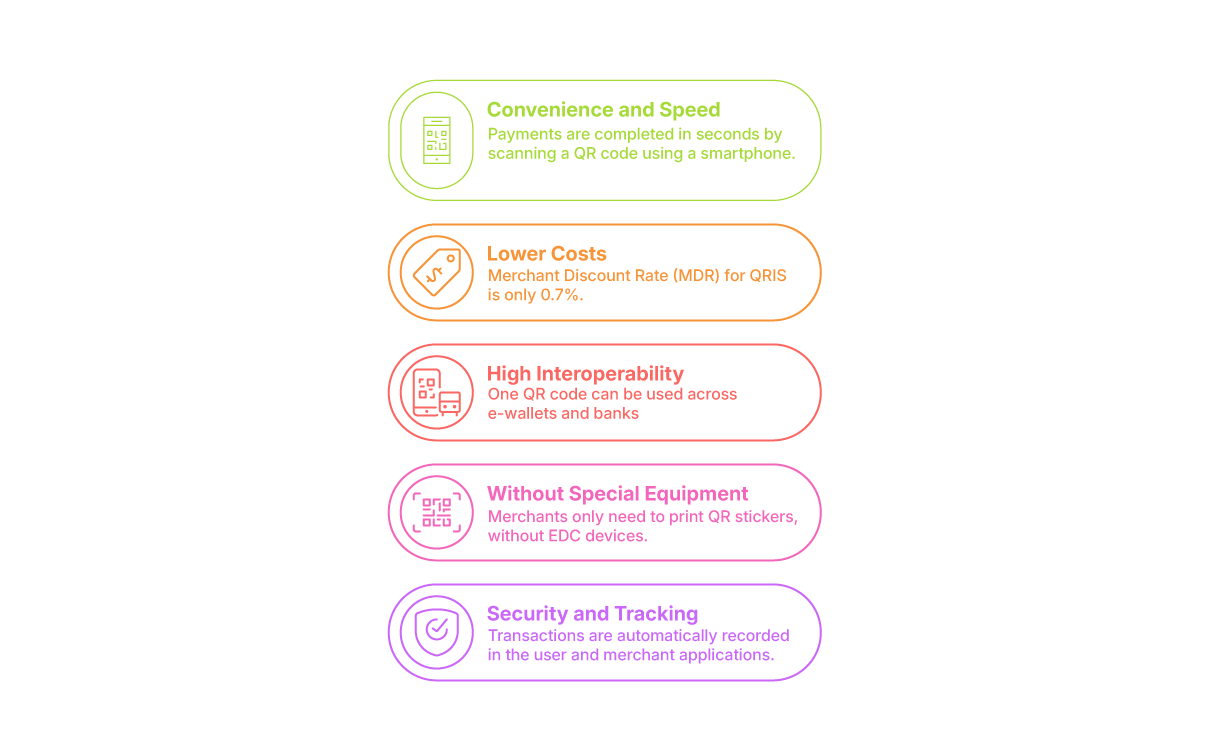

Advantages of QRIS: Cheap, Fast, Secure

Compared to international payment systems such as Visa and MasterCard, QRIS has several key advantages:

Unsurprisingly, QRIS is increasingly popular among small businesses and retail giants alike, as well as among the younger generation who are familiar with the cashless ecosystem.

Explosion in Transaction Volume and Value

In five years, QRIS transaction growth has increased exponentially:

Transaction volume grew from 124 million (2020) to 6.24 billion transactions in 2024.

Transaction value skyrocketed from Rp8.21 trillion (2020) to Rp659.93 trillion in 2024.

In early 2025, January alone recorded Rp80.88 trillion from 790 million transactions.

These figures exceed BI projections and mark a milestone in the growth of the national digital economy.

QRIS Replaces Visa and MasterCard

The surge in QRIS transactions has had a significant impact on transactions with the Visa and MasterCard networks. In 2024, debit card transactions with Visa/MasterCard principals fell by 11.4%. The number of ATM machines also continues to decline, indicating that people are increasingly abandoning conventional methods.

While Visa and MasterCard credit cards remain resilient, particularly in cross-border and premium segments, their dominance in domestic retail transactions is steadily eroding. Over the past decade, Visa’s global market share has declined from 57.7% to 38.7%, and MasterCard’s from 26.3% to 24%.

Why are users switching?

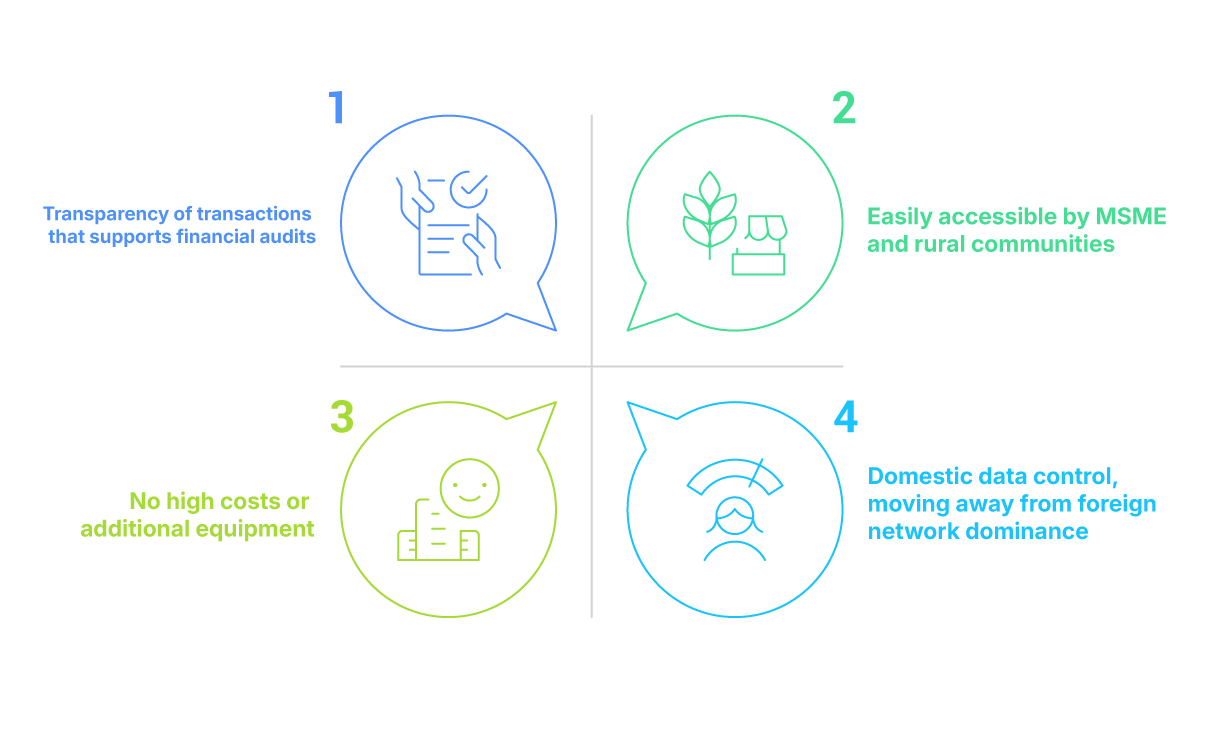

Users and merchants choose QRIS because:

Not only is it efficient, QRIS also supports the national strategy in realising data sovereignty and digital economic efficiency.

Economic Sovereignty and National Digitalisation

The use of QRIS not only has an impact on cost efficiency, but also supports digital sovereignty. Previously, transaction data via Visa/MasterCard had to go through overseas switching. Now, through QRIS, Indonesia has taken control of data and payment systems.

QRIS also accelerates financial inclusion. Without expensive infrastructure, businesses in villages and remote areas can actively participate in the digital payment system. As a result, QRIS is key to strengthening the digital economy, particularly in the SME sector, which is the backbone of the national economy.

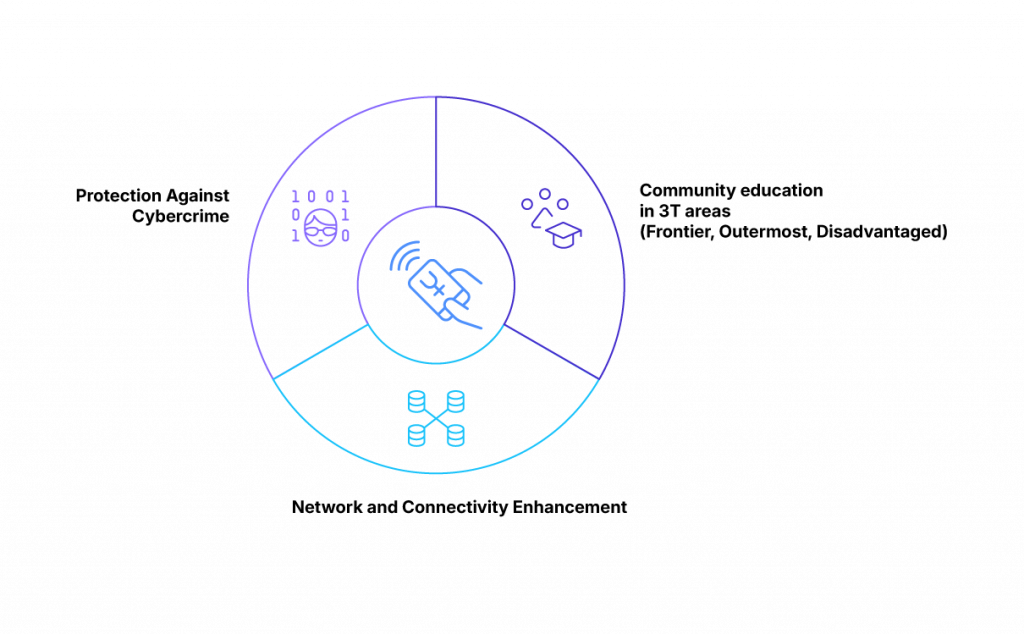

Challenges and Future Directions

Meskipun implementasi QRIS telah menunjukkan kesuksesan signifikan dalam mempermudah transaksi digital dan mendorong inklusi keuangan di Indonesia, sistem ini masih menghadapi sejumlah tantangan yang tidak bisa diabaikan. Berikut tantangan tersebut :

However, the government and BI continue to make improvements. Recent innovations such as QRIS Tap (NFC-based) and the development of cross-border payments within ASEAN indicate a bright future for QRIS.

QRIS has transformed the face of Indonesia’s payment system. From traditional markets to modern shops, from big cities to small villages, QRIS is the answer to the need for an inclusive, fast, secure, and inexpensive payment system. Its rapid growth proves the public’s preference for an efficient local system.

With a national strategy emphasising cost efficiency, financial inclusion, and domestic data control, QRIS is not only a payment tool but also a symbol of Indonesia’s digital economic sovereignty.

Aku suka QRIS