Tel-Access QRIS System

Digitise Your Business Transactions with QRIS Tel-Access

In the era of FINTECH, the ease of cashless transactions is highly prioritised, coupled with high customer mobility, thus requiring software/apps that can cover customer needs for online transactions, especially in terms of payments (finance).

QRIS Tel-Access now supports cross-border services

In accordance with the cooperation between Bank Indonesia (BI) and the Bank of Thailand (BoT), the implementation of cross-border QR Code-based payment cooperation between Indonesia and Thailand has been officially launched. Cross-border QR allows consumers and merchants in both countries to make and receive payments for goods and services via QR Code instantly, securely, and efficiently. The QRIS Tel-Access system supports cross-border QR services and continues to strive to develop the QRIS system optimally.

Tel-Access, as a proven and experienced IT solution provider in the field of payment, offers several solutions for financial institutions and fintech companies.

Tel-Access E-Wallet Application

QRIS Gateway

QR EDC Terminal

QRIS for Merchant

QRIS Training & Consultation

QRIS Cross-Border

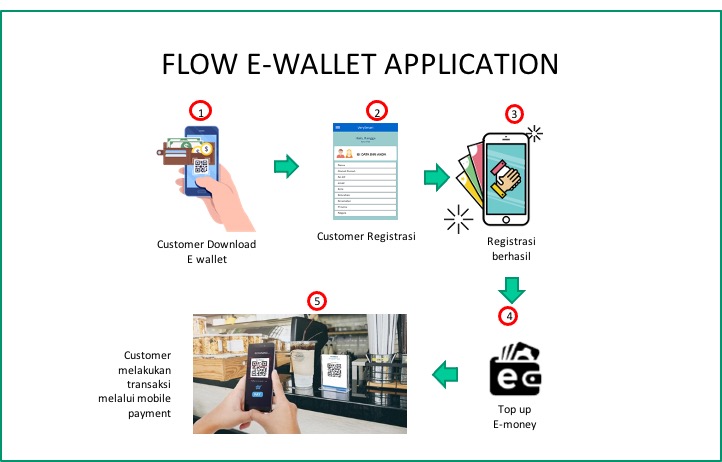

Tel-Access E-Wallet

Tel-Access e-wallet is a practical electronic wallet technology used for payment transactions and other transactions from mobile phones.

Tel-Access E-Wallet feature

-Bank transfers/transfers between apps

-Ticketing, mobile credit top-ups

-Withdrawals (cash withdrawals) between app users (cash in-cash out)

-Donation/crowdfunding services

-Product sales services

-Transaction services via barcode/QR code

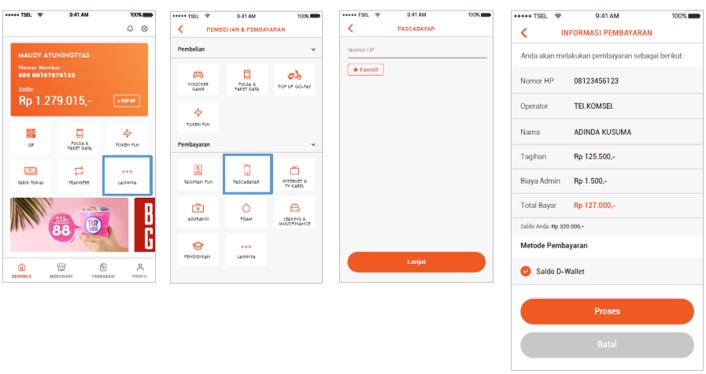

Tel-Access Wallet Display

Tel-Access QRIS Gateway

Solutions for financial institutions that already have e-Wallet applications but do not yet comply with the QRIS (Quick Response Indonesian Standard) standards from Bank Indonesia & OJK

Tel-Access provides QRIS Gateway for banks that have not yet adopted the QRIS standard.

The Bank Application will connect via Tel-Access QRIS Gateway

Tel-Acces QRIS Gateway is already connected to the switching system specified by Bank Indonesia, saving banks development and implementation costs.

Tel-Access has proven implementation of QRIS in one of the banks

Full support for changes from ASPI

Full support for changes from ASPI

Key Features of Tel-Access QRIS Gateway

-Secure Network Payment

-Payment transaction channels using ISO, JSON, API

-Supports AES 256 encryption

-Core banking connection ISO 8583

-Security host connection ISO 8583

-Switch communication ISO 8583

-QRIS switching connection using ASPI standard (luhn, sum check)

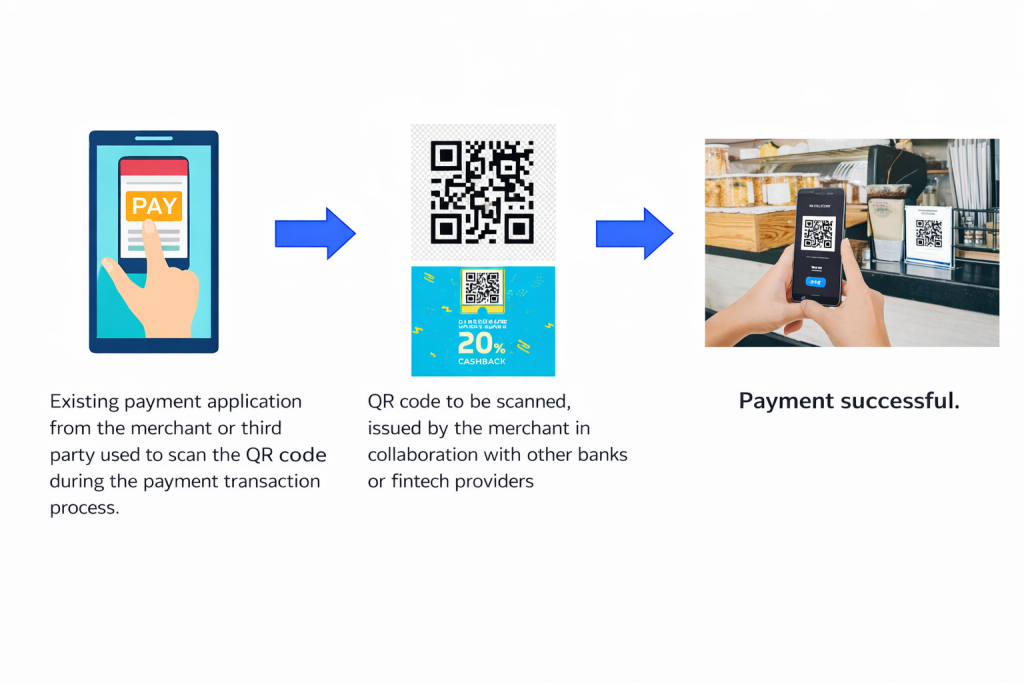

Tel-Access QRIS for Merchant

A solution for merchants who do not yet have an application or already have one, enabling them to have loyalty apps that are compatible with QRIS.

Tel-Access will provide middleware so that existing merchant applications can connect to the QRIS system.

Tel-Access can also provide EDC machines for merchants to conduct transactions via QRIS.

Flow QRIS For Merchant

Tel-Access Training For QRIS

Tel-Access will provide consultation and training so that banks can use QRIS services in accordance with the specifications provided by ASPI.

The consultation provided includes:

– Information about QRIS

– QRIS security and networking messaging standards

– Payment mechanisms through QRIS

– MDR percentage distribution in accordance with ASPI

Advantages of using Tel-Access's QRIS Solution

– Transactions via QR codes that comply with Bank Indonesia’s QRIS standards

– Tel-Access has extensive experience and a proven track record in implementing QRIS at banks

– Tel-Access has extensive experience in implementing systems that are integrated with banking systems

– Full support for changes from ASPI

– Improves the accuracy of customer transaction data, prevents data fraud, provides insight into the history of each customer purchase and payment transaction, and increases effectiveness and efficiency for the company